A cautionary tale about falling for potential.

I write this post specifically for my little sister, who’s yet to let go of a love that’s causing her both emotional and financial suffering. I hope you choose you someday. <3

Young ladies, you deserve the world. You deserve a love that loves you back with the same effort. A love that doesn’t require you to be depleted and unfulfilled in order to be successful. You deserve a life of peace, prosperity and ease. And you can have it all, if you so choose. Always choose you.

Via Mulala.blog

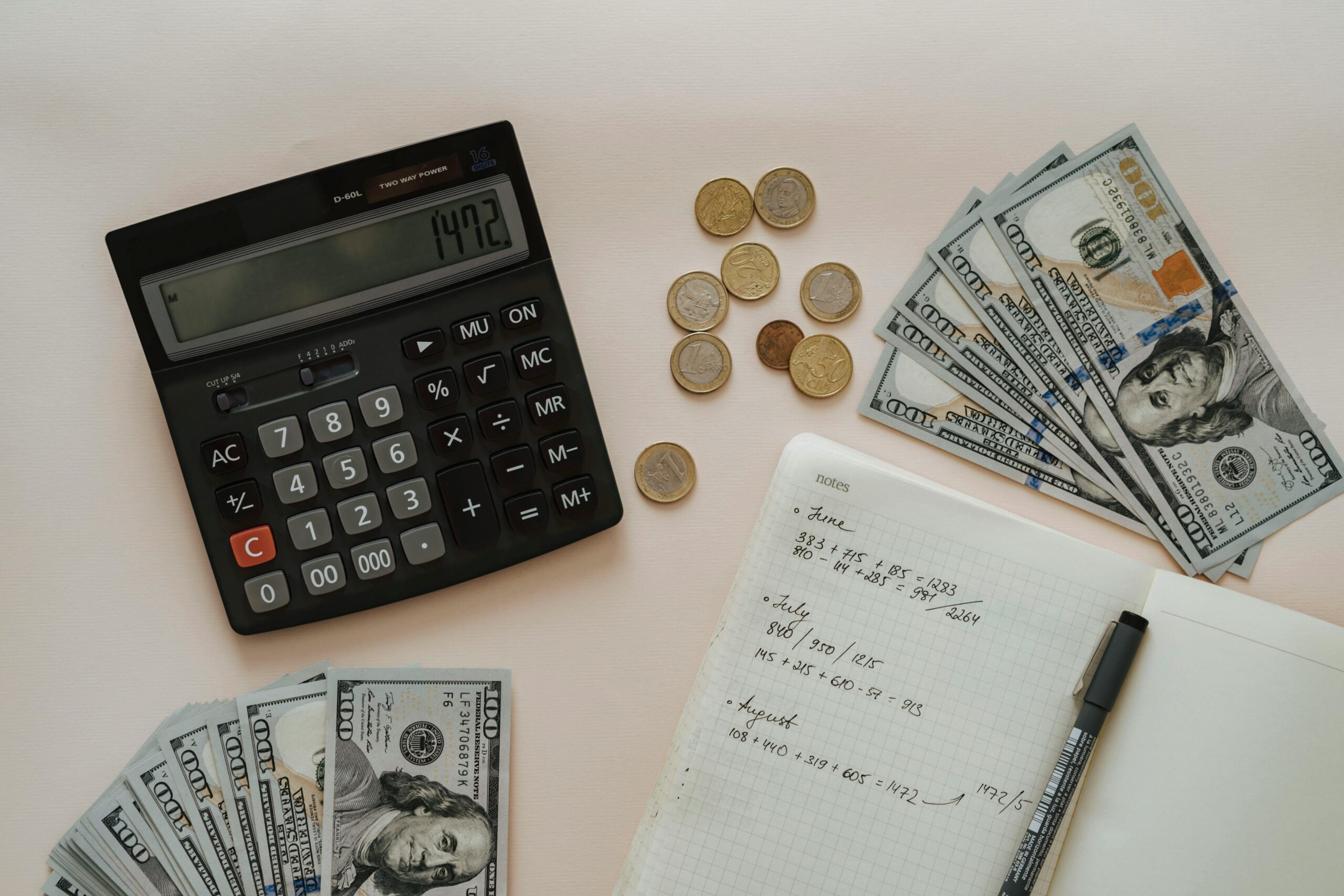

A relationship can be the most expensive thing you invest in. Sure with your time and effort, but if you’re not smart you’ll end up investing with your wallet with no ROI.

Was it love?

I witnessed my mother sacrifice herself for 20 years- in a relationship with an emotionally unstable partner, working two – even three jobs at a time just to make ends meet. All because he couldn’t do his share.

I watched her cry and endure the heartache of infidelity and mistreatment, only to watch her walk away in a divorce 20 years later with nearly nothing to her name.

What did she have to show for it?

From age 20 to 45 she had spent her life trying to accommodate a man that was never willing to rise to the occasion. Never willing to do the work required to become the man that he needed to be in order for the relationship to be successful.

Did their marriage fail because of him?

Or did my mother just fail to see the signs of emotional and financial infidelity that were there all along?

I don’t intend to place blame. There’s always two sides to every story. But if I could give one piece of advice to young women just stepping out into the real world it would be this-

Don’t give someone else the power to control your life.

You have the will, and the knowledge- even if you don’t believe so, to make the choice that best benefits you. It can be scary, and even hard – but it is necessary. Whether you choose the relation or you- choose wisely.

I’m going to speak to you as I would my little sister.

Take. Your. Time.

Don’t be in such a rush to check love off of your bucket list, that you avoid having the hard conversations that will affect your life for years to come.

You are young.

Get to know who you are, and who your spouse is before integrating anything- including your home but especially your money.

Remember everything always comes down to you, your values, and your deepest desires.

You have to make the best choice you can with whatever information you have. Make sure it’s one you can live with. The wrong relationship can cost you your money, your health and even your youth.

Is it worth it ? Or would you be better off focusing on loving you ?

How to Choose a Financially Stable Partner

Choosing a financially stable partner involves looking at various aspects of their life and behavior to make sure they align with your personal values and goals.

Below are some helpful tips to guide you in this process:

- Evaluate Financial Stability:

- Income and Employment: Look for someone with a steady job or career, which indicates financial stability. It’s not just about the amount they earn but their ability to manage and sustain it.

- Financial Management: Pay attention to how they handle their finances. Do they budget, save, and invest wisely? Are they responsible with credit and debt?

- Transparency: They should be open about their financial situation, including any debts or financial obligations.

2. Assess Emotional Independence:

- Self-Awareness: A non-codependent partner is generally self-aware and understands their own needs and emotions. They should have a good sense of their own identity and self-worth.

- Personal Interests: They should have hobbies and interests outside the relationship, indicating they have a fulfilling life on their own.

- Healthy Boundaries: Look for someone who respects boundaries and can communicate effectively. They should be able to express their needs without being overly reliant on you for emotional support.

3. Observe Relationship Dynamics:

- Conflict Resolution: How do they handle disagreements? A non-codependent person should approach conflicts with a focus on resolution rather than seeking validation or approval.

- Supportiveness: They should support your goals and aspirations, and vice versa, without feeling threatened or insecure.

- Self-Reliance: Check if they take responsibility for their own happiness and well-being without placing that burden on you.

4. Discuss Future Goals:

- Financial Goals: Have conversations about financial aspirations and habits. Are your long-term financial goals compatible?

- Relationship Goals: Discuss expectations for the relationship and ensure that both of you have similar views on commitment, independence, and partnership.

5. Check for Signs of Dependency:

- Emotional Reactions: Notice if they rely excessively on you for emotional stability or validation. Codependent individuals often seek to meet their needs through their partner.

- Decision-Making: See if they are capable of making decisions independently and handling life’s challenges without undue reliance on you.

How To Combine Finances with Your Partner

- Have an open discussion about your debt, spending habits and common goals. Find some common ground and plan accordingly.

- Create a budget and stick to it. Automate as much as you can to make sure you are prioritizing saving and avoiding overspending.

- Choose a bank for joint accounts. Whether you decide to have your checkings and savings at the same bank or separate- make sure it’s one that works for both of you (convenience, fees, etc.) Preferably one with a good interest rate like Ally.

- Choose your own bank for your personal money or have a separate account at the same bank.

- Track your spending and adjust accordingly. Sometimes it take a couple of months to get a true idea of your spending. You’d be surprised the areas you spend on most (I’m looking at you DoorDash) You can use apps like YNAB or Mint for these. Or a google spreadsheet will do. Whatever works for you.

- Automate as much as you can. It’ll save you so much time, trust me! And it helps avoid forgetting to pay a bill!

Summary

Alas, choosing a partner who is financially stable and emotionally independent requires a balance of practical considerations and emotional insights. Always look for someone who adds value your life without overshadowing your personal growth and well-being.

P.S. Feel free to comment and let me know what you think of this post. Do you prefer the emotional appeal and backstory, or do you just like to get to the juicy tips? Let me know what you think.

XOXO, Fina.